HIGHLIGHTS

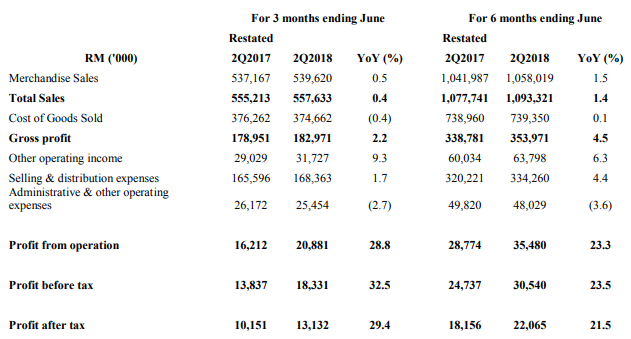

• 2Q18 Total sales growth of 0.4% and year to date (YTD) 2Q18 total sales growth of 1.4%.

• 2Q18 Net profit growth of 29.4% and year to date YTD 2Q18 Net profit growth of 21.5%

• Gross Profit Margin continues to improve versus last year.

• Continued store expansion bringing the total network to 2,241 stores.

Comments from Chief Executive Officer – Colin Harvey

We are happy with our net profit growth of 29.4% for the quarter, however we believe that there is room to improve on a number of key metrics. I am personally excited to have joined the business just over 2 weeks ago, and I am confident that a strategy roadmap focussed on strengthening the key areas of, assortment, supply chain, operational excellence, store base, and digitally enabling the organization will bear fruit in terms of financial performance, and overall customer shopping experience.

I look forward to the challenges ahead in ensuring that 7-Eleven Malaysia remains the customers first choice convenience store.

For the 2nd Quarter ended 30 June 2018

The Group’s revenue for the current quarter of RM557.6 million grew by RM2.4 million or 0.4% against the corresponding quarter’s revenue in the previous year of RM555.2 million. The growth in revenue continued to be driven by the growth in new stores and better consumer promotion activity.

Gross profit of RM183.0 million improved by RM4.0 million or 2.2% compared to the corresponding quarter in the previous year. This was mainly attributed to the increase in revenue and improvement in gross margin by 0.6% points. The improvement in gross margin was attributed to higher gross profit margins across most categories.

Selling and distribution expenses for the quarter increased by RM2.8 million or 1.7% against the corresponding quarter of the previous year. This was mainly due to new store expansion resulting in higher rental cost, store depreciation, maintenance expenses and staff costs.

Administrative and other operating expenses for the quarter decreased by RM0.1 million or 2.7% due to lower staff cost.

The increase in revenue, gross margin improvement and other operating income resulted in the Group’s profit after tax of RM13.1 million, an increase of RM3.0 million or 29.4% as compared to the corresponding quarter in previous year.

For the 6 months ended 30 June 2018

For the 6 months ended 30 June 2018, the Group’s revenue of RM1.09 billion grew RM15.6 million or 1.4% against the corresponding period in the previous year of RM1.08 billion. The growth in revenue was driven by the growth in new stores and consumer promotion activity.

Gross profit improved by RM15.2 mil or 4.5% compared to the corresponding 6 months in the previous year. This was mainly attributed to the revenue growth and gross profit margin expansion of 0.9% points. Other operation income grew by RM3.8 million or 6.3% compared to the corresponding 6 months in the previous year.

The Group’s profit after tax recorded RM3.9 million or 21.6% increased against the corresponding period in the previous year driven by higher profit contribution amongst most product categories.

Future Prospects

The Board of Directors is of the view that the trading conditions for the next quarter are expected to improve with the

anticipated heightened consumer sentiment. We expect to see further improvements in the next quarter by pursuing

our core strategy pillars of Operations Excellence, Cost Management and Commercial Innovation.