HIGHLIGHTS

• One2Pay mobile wallet launched in January 2018, with payments and top ups enabled in all stores.

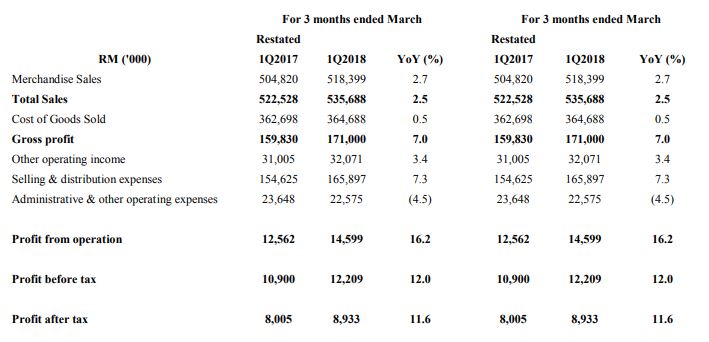

• 1Q18 Total sales growth of 2.5%

• Gross Profit Margin continues to improve versus last year.

• Continued store expansion bringing the total network to 2,235 stores.

Comments from Acting CEO – Ho Meng

We are pleased with our net profit growth of 11.6%. This improvement has been driven by an increase in revenue, gross margin improvement and higher other operating income. We will continue to leverage our supply chain operations and sharpen our offerings to our customers, with a key focus of Fresh Food and Instore services in order to reaffirm 7-Eleven Malaysia as our customer’s first choice convenience store operator. We are also hopeful that 7-Eleven Malaysia, with the largest convenience store network in Malaysia would be in a favourable position to benefit from higher consumer purchasing power due to the upcoming 0% GST with effect from 1st of June 2018.

For the 1st Quarter ended 31 March 2018

The Group’s revenue for the current quarter of RM535.7 million grew by RM13.2 million or 2.5% against the corresponding quarter’s revenue in the previous year of RM522.5 million. The growth in revenue continued to be driven by the growth in new stores, higher customer counts and better consumer promotion activity.

Gross profit of RM171.0 million improved by RM11.2 million or 7.0% compared to the corresponding quarter in the previous year. This was mainly attributed to the increase in revenue and improvement in gross margin by 1.3% points. The improvement in gross margin was due higher gross profit margins across all categories.

Selling and distribution expenses for the quarter increased by RM11.3 million or 7.3% against the corresponding quarter of the previous year. This was mainly due to new store expansion resulting in higher rental cost, utility cost, store depreciation and maintenance expenses.

Administrative and other operating expenses for the quarter decreased by RM1.1 million or 4.5% due to decrease in staff cost.

The increase in revenue, gross margin improvement and other operating income resulted in the Group’s profit after tax of RM8.9 million, an increase of RM0.9 million or 11.6% as compared to the corresponding periods in previous year.

Future Prospects

The Board of Directors is of the view that the trading conditions for the next quarter are expected to improve with the anticipated heightened consumer sentiment. We expect to see further improvements in the next quarter by pursuing our core strategy pillars of Operations Excellence, Cost Management and Commercial Innovation.