Online shoppers can insure their purchases against accidental damages, including wear and tear, for less than RM1 and enjoy coverage of up to RM10,000 with PolicyStreet’s Damage Protection Plan.

KUALA LUMPUR, 14 FEBRUARY 2023 – Malaysians can bid goodbye to their worries of accidentally damaging their online purchases during normal usage. Protecting online shoppers in Malaysia, PolicyStreet is launching its Damage Protection Plan, Malaysia’s most comprehensive embedded protection product to date. Starting at less than RM1, Malaysians can enjoy damage protection of up to RM10,000 on more than 800 categories of items available on partnering e-commerce platforms.

The Damage Protection Plan protects shoppers’ purchases against accidental damage, fire, flood, and theft for up to six months after delivery. Baby clothing, furniture, travel and luggage, mobile phones and gadget accessories are also eligible for wear and tear damage compensation up to three months after purchase. Wear and tear coverage in the Damage Protection Plan acts as a quality assurance policy, allowing customers to be compensated when gradual damages such as shrinkage, rust, or damage by rodents or insects occur due to the nature of the product itself.

“Online shoppers are typically concerned with ensuring that their purchases arrive in good condition, but they frequently overlook that the risk of product damage does not end there. With life’s uncertainty, material damage caused by unforeseeable events can be financially draining. Being a licensed Reinsurer and General Insurer, we are committed to underwriting a product that addresses the protection gap in this respect,” says Lee Yen Ming, Co-founder and Chief Executive Officer of PolicyStreet.

“Understanding that nine out of ten Malaysians prefer shopping online[1], we are partnering with e-commerce platforms to address the issue at its source. Rather than proactively encouraging Malaysians to insure their belongings, we’re incorporating damage protection into their online purchase journey, so online shoppers can be protected from the moment they receive their purchase,” adds Yen Ming.

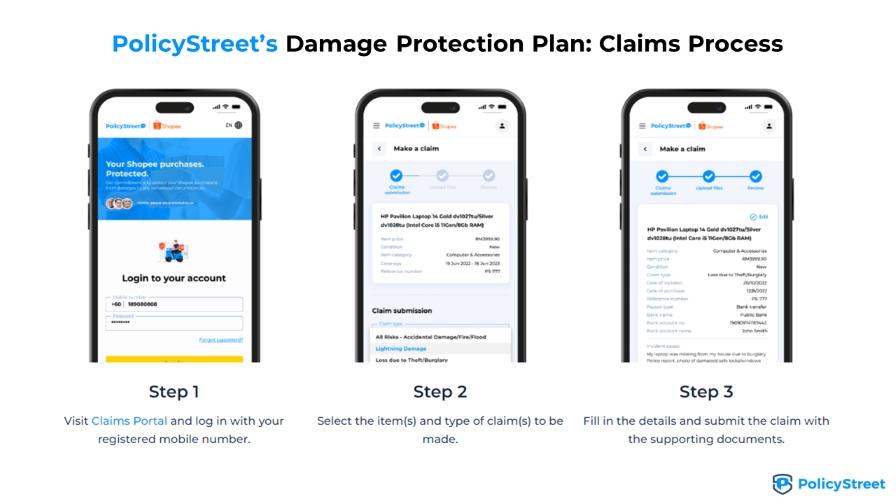

Mirroring the technologies and processes used in PolicyStreet’s Gig Workers’ Claims Platform, the Damage Protection Claims Platform simplifies the claims processes by providing shoppers with clear guidelines and next steps. After submitting a claim, shoppers can also track the status of their claims through the same portal. Shoppers can also decide where the claims are paid, either by bank transfer or their respective E-Wallets supported by the respective e-commerce platforms. Processing periods for the E-Wallets will take 3-5 working days, whereas bank transfers will take 7-10 working days.

Malaysians were eager to adopt the Damage Protection Plan as millions of policies were sold in just one month. As an emerging insurtech company, the positive response is a testament to PolicyStreet’s understanding of consumers’ needs and its commitment to protecting communities through its innovative range of insurtech products. To better reflect the company’s ability to offer innovative insurance solutions, the insurtech company refreshed its branding by launching a new logo. The updated logo consists of the company name’s acronyms (PS), creatively depicting a shield to represent their commitment to protecting communities.

Don’t miss out on additional protection; Check out PolicyStreet’s latest insurtech offering and enjoy the benefits of the Damage Protection Plan now by opting in at the checkout page! For detailed information on the Damage Protection Plan’s coverages, please visit the terms and conditions page HERE.

About PolicyStreet

PolicyStreet is an insurance technology group of companies providing cutting-edge digital insurance solutions to businesses and consumers in Southeast Asia and Australia.

PolicyStreet works directly with over 40 life, general, and takaful providers globally to offer a comprehensive range of products and services, which includes but is not limited to embedded insurance, customised employee benefits, financial advisory and aggregation of insurance, as well as the development of digital solutions to make insurance purposeful & simple for businesses and consumers.

As a licensed Reinsurer and General Insurer by the Labuan Financial Services Authority (LFSA), an approved Financial Adviser and Islamic Financial Adviser by Bank Negara Malaysia (BNM), and a licensee of the Australian Financial Services License by the Australian Securities and Investments Commission (ASIC), PolicyStreet is able to underwrite, customise policies, and provide unbiased advice to its clients and partners worldwide.

Through its regional group of companies, it serves more than 500,000 customers with over US$ 4 billion in sum insured. In 2022, it was named as one of the 100 Leading Emerging Giants in the Asia Pacific by KPMG and HSBC and was recognised at the Top in Tech Innovation Awards 2022 for Most Value Creation. It was also awarded the Young Entrepreneurs’ Award in 2020 by ASEAN Business Advisory Council (ASEAN-BAC).

[1] Malaysia e-shopping king of the region, 9 out of 10 online by end-2021, The Edge Markets, 20 October 2021