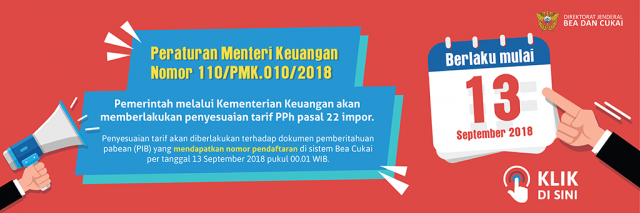

The Indonesian government is increasingly becoming protectionist following the recent imposition of an import tax of between 7.5% and 10% on imported consumer goods on 13 September 2018. The tax is aimed at improving the country’s current account balance and to shore up the local currency. A total of 1,147 consumer goods are affected with a higher import tax, up from the existing rate of 2.5% and 7.5%.

A complete list of the affected products can be found in this link.

Among the products affected levied at the 10% rate are cosmetics and personal toiletries. Taxed at 7.5% are:

- Other prepared or preserved meat (HS 1602)

- Prepared or preserved fish (HS 1604)

- Sugar confectionery (including white chocolate) (HS 1704)

- Chocolate and other food preparations containing cocoa (HS 1806)

- Pasta, whether or not cooked or stuffed (with meat or other substances) or otherwise prepared (HS 1902)

- Prepared foods from swelling or roasting cereals or products (HS 1904)

- Bread, pastry, cakes, biscuits and other bakers’ wares (HS 1905)

- Preparations of vegetables, fruits, nuts or other parts of plants (HS 2006)

- Extracts, essences and concentrates, of coffee, tea or maté and preparations (HS 2101)

- Sauces and preparations thereof, mixed condiments and mixed seasonings, mustard flour and meal and prepared mustard (HS 2103)

- Ice Cream And Other Edible Ice (HS 2105)

- Tempe (HS 2106.90.97)

- Waters, including mineral waters and aerated waters, containing added sugar or other sweetening matter or flavoured (HS 2202)

- Wine of fresh grapes, including fortified wines (HS 2204)

- Vermouth and other wine of fresh grapes flavoured with plants or aromatic substances (HS 2205)

- Other fermented beverages (HS 2206)

- Undenatured ethyl alcohol of an alcoholic strength by volume of less than 80% (HS 2208)

Instant noodles and soy milk drinks are imposed with a 7.5% import tax. Excluded from the tax are dairy products which are heavily dependent on import.