- Pandemic-induced shake-ups posed an enormous challenge for e-commerce logistics in Southeast Asia.

- Singapore & Thailand have seen the least change in the average delivery time during social distancing.

- E-commerce delivery companies introduced innovations to their technology and protocols to cope with the situation.

- Parcel Monitor and iPrice Group examine these innovations, the stage of the industry, and where we go from here.

When COVID-19 hit ASEAN back in February, forcing countries to comply with social distancing measures, e-commerce businesses found themselves becoming essential services.

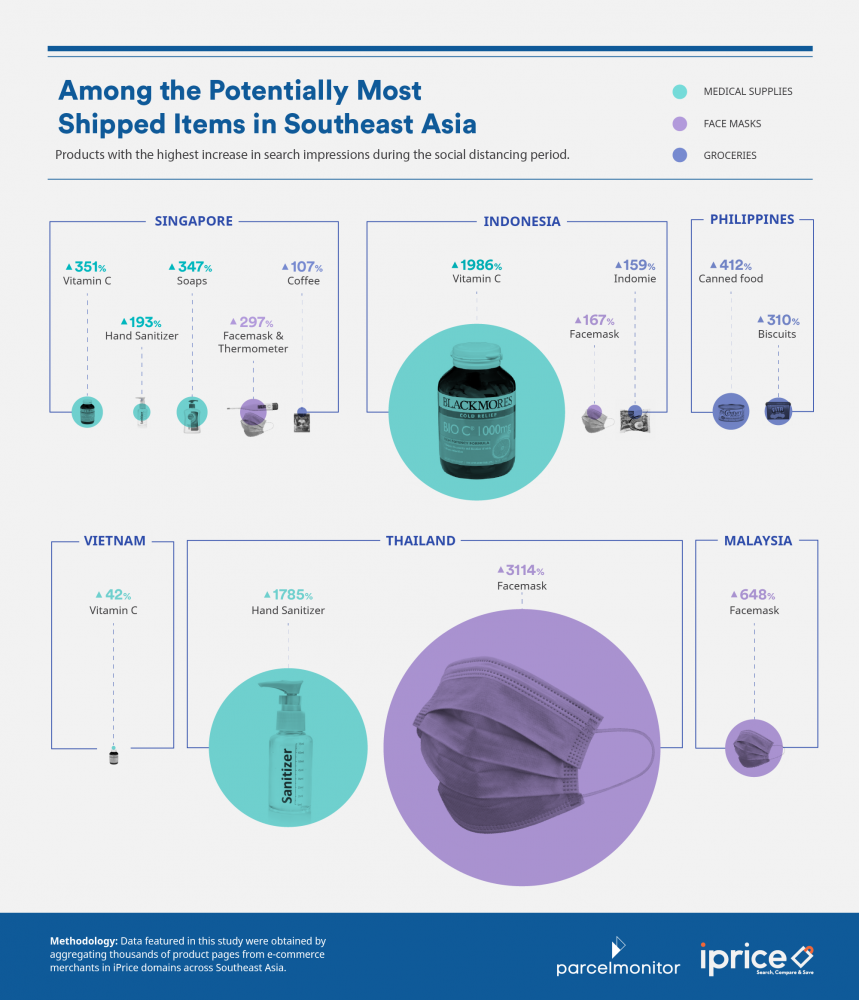

Unable to visit physical stores, consumers turned to online shopping for their everyday essential purchases like medical supplies and groceries. E-commerce aggregator, iPrice Group, reported in April that health supplements, face masks, and canned goods were among the most sought-after on regional e-commerce websites.

It became a priority for delivery companies to ensure that these essentials reach their destinations on time. But with logistics operations disrupted by COVID-19 worldwide, this has proven an enormous challenge.

Unprecedented challenges

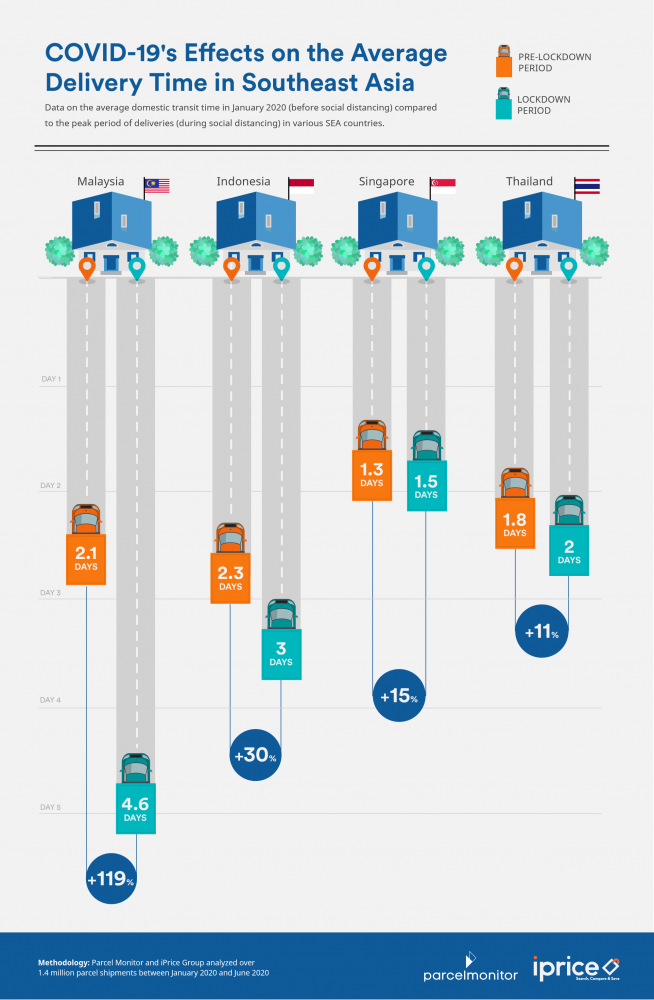

Data on delivery speed collected by Parcel Monitor, a global e-commerce logistics community, shows exactly how difficult it is.

The worst impacts of social distancing on e-commerce deliveries were felt in Malaysia, where delivery time rapidly increased from 2.1 days (pre-social-distancing), peaking at 4.6 days (during social distancing). Similarly, in Indonesia, parcels took 3 days to reach destinations during the implemented social distancing measures, significantly slower than the previous average of 2.3 days.

Situations were better in Thailand and Singapore, but even in these countries, the average delivery time still increased by 0.2 days during the months when social distancing measures were implemented.

Comments from Ninja Van, a courier company with renowned e-commerce partners like Lazada, Shopee, and Zalora, among others, paint the same picture. A representative shared that their business across the region was affected in various degrees by the pandemic.

E-commerce experienced a jump in demand during the pandemic, with traffic growing up to 60% in April and May according to iPrice Group’s data, leading to an increase in parcel volumes in most ASEAN markets.

Some shippers were operating on shorter hours, which are measured to ensure the safety and well-being of their staff. More bulky parcels were also being shipped, which affected productivity, Ninja Van’s representative confirms.

In addition, limited flights and sailings across the region have resulted in delays and increased cost for logistics, as pointed out by Mr. Timothy M. Kairuz, Business Development Manager at Filipino logistics provider Transglobe Logistics International Inc.

Parcel Monitor also expressed concerns that these strains on delivery speed were affecting customer experience. They have noted surges in customer complaints, missing parcels, and customer service calls, leading to a poor experience for all parties involved in the delivery process.

Delivery companies across the region desperately needed to change the way they operate.

The future driven by smart solutions

Parcel Monitor discovered that a potential solution to the aforementioned challenges is the rising usage of parcel locker networks in Southeast Asia. These lockers help to ensure fast and flexible delivery services while minimizing direct contact between delivery personnel and customers.

For instance, the Singaporean government recently announced the development of 1,000 parcel locker stations nationwide scheduled for completion by the end of 2021. Meanwhile, parcel locker stations are also in 86 LRT stations in Malaysia, courtesy of Ninja Van and Prasarana Malaysia Berhad’s partnership in 2019, whereas PopBox and Box24 brought the same concept to Indonesia and Thailand respectively.

“This will be a delivery trend that will continue to grow in ASEAN as e-commerce logistics in the region continues to mature,” concluded Dr. Arne Jeroschewski, Founder and CEO of Parcel Monitor & Parcel Perform.

Dr. Jeroschewski further suggests that visibility and transparency on the delivery journey will become a key solution to improve customer experience for both recipients and merchants. “Customers want to know where the parcels are, what’s happening to them, and when to expect their orders at their doorstep,” said Dr. Jeroschewski.

In that regard, Ninja Van seems to be on the right track as they are already offering live tracking and a live chat feature that allow parcel recipients to better communicate with shippers while having full visibility of their parcels.

“We believe that being able to better connect and communicate with our shippers and parcel recipients allows the consumers to have high visibility of their parcels while staying updated about any new services or products,” said Ninja Van Co-founder and CEO Mr. Lai Chang Wen.

FedEx’s tracking device, SenseAware, on the other hand, gives merchants and senders round-the-clock updates on a delivery package, including information on temperature and humidity, which is highly important for essential products such as medicine and fresh groceries.

Finally, in response to the sharp uptick in demand for manpower, each company is applying their own technological solutions with the same goal of quickly ramping up capacity. Vietnamese express courier, Giaohangnhanh, recently unveiled an automatic sorting warehouse, which is the first of its kind in the country that they claim can help reduce manpower demand by up to 75%.

Meanwhile, Ninja Van focuses on automating intuition, which allows their staff to be less dependent on lengthy training procedures and to quickly familiarize themselves with operating processes.

Results of these solutions can already be seen in most countries by June. Parcel Monitor’s latest data shows that most of these countries’ average delivery speeds are already returning to pre-COVID-19 levels.

Malaysia’s e-commerce parcels now take an average of 3.1 days to reach buyers, which is an enormous improvement compared to the social distancing period. However, it is still slower compared to delivery speeds seen at the beginning of the year. Singapore’s delivery activities are back to the same level seen before social distancing while Indonesia also seems to be following the same trend.

The overall quick responses and improvements seen across the region show great potential for e-commerce and parcel delivery services in ASEAN.

“The pandemic has shown that the demand for e-commerce is on the rise and here to stay for the long haul,” Dr. Jeroschewski of Parcel Monitor offers an optimistic outlook, “there will be many upcoming opportunities for new players in the e-commerce logistics space to take advantage of this growth in e-commerce, and they may offer an even better experience to the customers.”

Methodology

Parcel Monitor and iPrice Group analyzed over 1.4 million parcel shipments in Singapore, Malaysia, Thailand, and Indonesia between January 2020 and June 2020.

About Parcel Monitor

Parcel Monitor is the global knowledge-sharing community dedicated to e-commerce logistics for retailers, logistics carriers and end-consumers around the world. Through logistics data and the collective wisdom of the community, Parcel Monitor creates a collaborative space for the e-commerce logistics industry, enabling a transparent and better delivery experience for everyone. Founded in 2016, Parcel Monitor also serves as a platform for end-consumers to obtain real-time shipment tracking updates across all carriers and countries. End-consumers can also provide qualitative feedback on the delivery experience. The platform tracks millions of shipments every month.

About iPrice Group

iPrice Group is a meta-search website operating in seven countries across Southeast Asia namely; Malaysia, Singapore, Indonesia, Thailand, Philippines, Vietnam, and Hong Kong. Currently, iPrice compares and catalogues more than 1.5 billion and receives about 20 million monthly visits across the region. iPrice currently operates three business lines: price comparison for electronics and health & beauty; product discovery for fashion and home & living; and coupons across all verticals.