HIGHLIGHTS

• Stores operating under strict SOPs and shorter operating hours affecting customer footfalls.

• Convenience stores (7-Eleven) Core PAT increased RM1.2m or 28.6%

• Pharmaceutical segment (include The Pill House and Wellings) PAT increased RM0.9m or 15.7%

• Higher Group’s PAT at RM3.6m compared with RM2.7m in 2Q2020, an increase of +RM0.9m or +35.2% vs 2Q2020.

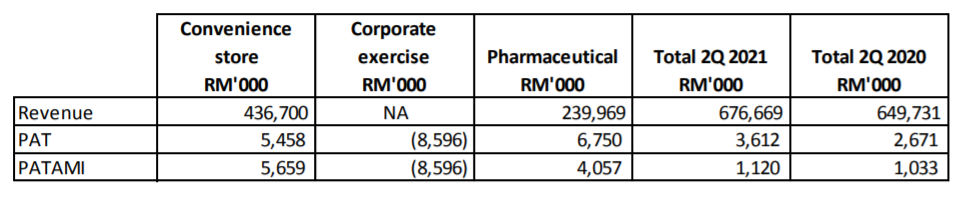

Review of Current Quarter Performance versus Corresponding Quarter Last Year

The re-introduction of Movement Control Order 3.0 starting 3 May 2021 in several states and the nationwide Full Movement Control Order effective 1 June 2021 have affected the group’s performance in the current quarter. Stores are operating under strict SOPs and reduced operating hours affecting customer footfalls. In comparison to previous year corresponding quarter, the country was in a less restrictive Conditional Movement Control Order and Recovery Movement Control Order which started on 10 June 2020.

Convenience Stores Segment

Revenue from convenience stores declined by RM74.3m or 14.5%. Most product categories except fresh foods recorded lower revenue while sales mix improved resulting in lower gross profits of RM9.8m or 6.9%.

Operating expenses decreased for the current quarter by RM13.1m or 8.1%, due to lower wages from better manpower planning, shorter operating hours and lower shrinkages. Despite lower gross profits, the convenience store segment still achieved a core Profit After Tax of RM5.4mil which is an increase of RM1.2mil compared to previous year corresponding quarter.

Corporate exercise expenses which is primarily professional fees from issuance of Medium Term Note, interest to finance the acquisition of Caring Group and fair value gain from investments in quoted shares, increased by RM1.0m to RM8.5m for the quarter.

Pharmaceutical segment

Revenue from pharmaceutical segment increased by RM100.9m or 72.5% to RM240.0m. While Profit After Tax increased by RM0.9m or 15.7% to RM6.8m, mainly driven by higher revenue. The acquisition of The Pill House and Wellings contributed revenue of RM66.8mil.

Consolidated Group

The Group’s consolidated Profit after Tax for the current quarter, after taking into consideration corporate exercise expenses stands at RM3.6m, an increase of RM0.9m or 35.2%.

Revenue from the convenience stores declined by RM244.9m or 21.7%, Most product categories recorded lower revenue resulting in lower gross profits. Excluding expenses incurred in the corporate exercise, the convenience store segment recorded a core Profit After Tax of RM15.5m, a decline of RM8.7m or 35.9%.

Corporate exercise expenses incurred for 6 month ended 30 June 2021 reduced by RM4.7m.

Revenue from pharmaceutical segment increase by RM117.7m or 35.6% to RM448.0m. While Profit After Tax closed at RM13.2m. The acquisition of The Pill House and Wellings contributed revenue of RM108.9m.

The Group’s consolidated Profit After Tax for the 6 months ended 30 June 2021 after taking into consideration the corporate exercise expenses is reported at RM17.1m.

PROSPECTS

With consumers focusing on their wellbeing and overall health, our retail pharmaceutical segment proved to be a resilient and defensive acquisition for The Group amidst this pandemic. This has and will continue to support the Group’s performance. Though consumer sentiments remain a challenge for our convenience stores during these trying times, The Group is hopeful that the combination of a successful implementation of the National Recovery Plan; and the progress of the National Immunisation Programme will help with overall trading conditions. We will continue to focus on our customer’s needs by pursuing our core strategic pillars for both segments of our Group.