HIGHLIGHTS

- 2Q17 Sales growth of 9.8% and year to date (YTD) 2Q17 sales growth of 4.4%

- 2Q17 average spend per customer increase of 2.6% and 1.3% in YTD 2Q17.

- Gross Profit Margin continues to improve versus last year.

- Same Store Sales Growth (SSSG) increase of 2.4% in 2Q17.

- 77 new stores have been opened in 2017 resulting in a total store network of 2,186 stores as at the end

of June 2017

Comments from Acting CEO – Ho Meng

We achieved significant improvement in our revenue and net profit in the second quarter of 2017 by 6.3% and 26.8% respectively compared to the first quarter. We are confident that our strategic review of the business and the implementation of our “Back to Basics” program, will strengthen and solidify 7-Eleven Malaysia as the customer’s first choice of convenience store operators. This will be achieved via, the effective leveraging of our supply chain operations, and the sharpening of our offerings to our customers, with a key focus on Fresh Food and In-store services.

For the 2nd Quarter ended 30 June 2017

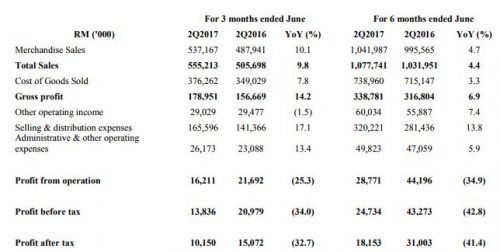

The Group’s revenue for the current quarter of RM555.2 million increased by RM49.5 million or 9.8% against the corresponding quarter’s revenue in the previous year of RM505.7 million. This increase in revenue is mainly due to Hari Raya festive period and new store growth. There was also positive growth in existing stores.

Gross profit of RM179.0 million increased by RM22.3 million or 14.2% compared to the corresponding quarter in the previous year. This was mainly attributed to the increase in revenue recorded and improvement in gross margin by 1.2% points. The improvement in gross margin was due to higher sales contribution from those categories with higher gross profit margins as well as tighter promotion management.

Other operating income remained fairly stagnant compared to the corresponding quarter in the previous year.

Selling and distribution expenses for the quarter increased by RM24.2 million or 17.1% against the corresponding quarter of the previous year. This is mainly due to impact of minimum wage which came into effect from 1st July 2016, new store expansion and depreciation, and inventory shrinkages. Administrative and other operating expenses for the quarter increased by RM3.1 million or 13.4% mainly due to increase in staff cost, IT maintenance and professional fees.

This resulted in the Group’s profit before tax of RM13.8 million, a decrease of RM7.1 million or 34.0% as compared to the corresponding period in the previous year.

For the 6 months ended 30 June 2017

For the 6 months ended 30 June 2017, the Group’s revenue of RM1.08 billion grew by RM45.8 million or 4.4% against the corresponding period in the previous year of RM1.03 billion. The growth in revenue was driven by the growth in new stores and Hari Raya celebration.

Gross profit improved by RM22.0 mil or 6.9% compared to the corresponding 6 months in the previous year. This was mainly attributed to the revenue growth and gross profit margin expansion of 0.7% point largely contributed by the 1.2% point increase for the current quarter. Other operating income grew by 7.4% compared to the corresponding 6 months in the previous year.

Selling and distribution expenses for the 6 months period in 2017 increased by RM38.8 million or 13.8% against the corresponding period of previous year. This is mainly due to the factors that affected the current quarter.

Administrative and other operating expenses increased by RM2.8 million or 5.9% vis-à-vis the corresponding 6 months

in the previous year. This is also mainly due to the factors that affected the current quarter.

This resulted in the Group’s profit before tax of RM24.7 million, a decrease of 42.8% or RM18.5 million compared to the corresponding 6 months in the previous year.

Future Prospects

The Board of Directors is of the view that the trading conditions for the remaining period of the current financial year are expected to remain challenging. We expect to see continued improvements in the next two quarters by pursuing our core strategy pillars of Operational Excellence, Cost Management and Commercial Innovation.