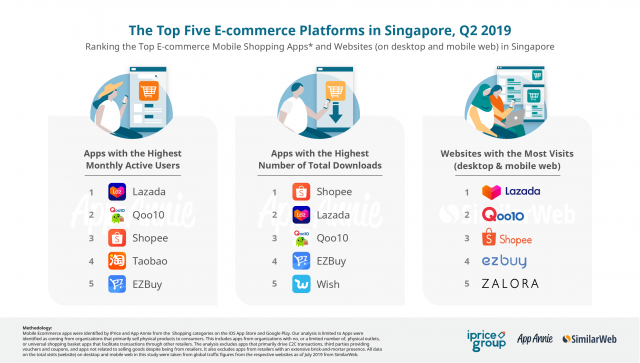

Analysing the Leading E-commerce Shopping Apps & Websites in Singapore as of Q2 2019

- According to App Annie Intelligence, Lazada’s mobile app garnered the highest Monthly Active Users (MAU) in Singapore in Q2 2019. It was also the most visited platform (desktop & mobile web), recording an average 7.5 million visitors in the same period.

- The Singaporean-focused company, Qoo10 has benefited from its localisation strategy and is the 2nd most actively used mobile e-commerce shopping app in Singapore. Qoo10 is also the third most downloaded app in the country.

- Shopee is the most downloaded mobile e-commerce shopping app in Singapore & garnered more than 2.8 million average visitors.

- Taobao is the most actively used mobile e-commerce shopping app that isn’t tailored for the Singaporean market.

The end of H1 2019 marks an important milestone for e-commerce in Singapore as we draw closer to Google & Temasek’s SG$27 billion prediction on the size of the country’s internet economy by the year 2025. In the same report, Google stated that e-commerce is the most ‘dynamic sector’ in the internet economy, with an expected 18% CAGR growth in less than seven years.

This study was conducted to keep track on the latest developments of the internet economy’s most ‘dynamic sector’ in Singapore and across Southeast Asia’s largest digital markets. The rapid growing e-commerce companies such as Lazada, Qoo10, Shopee, and Taobao have been deploying strategies to build stronger improvements to provide reliable services for Singapore value-driven shoppers.

Together with our partner App Annie Intelligence, we have updated

our quarterly study Map of E-commerce to picture the biggest developments in e-commerce shopping app via

the average of Monthly Active Users (MAU) and downloads. In addition to this,

we also analysed the total average visits (desktop & mobile web) garnered

by the top e-commerce platforms in Singapore utilising data by SimilarWeb in Q2

2019.

Lazada Recorded the Highest MAU (Mobile App) & the Highest Total Visits (Desktop & Mobile Web) on its Website in Q2 2019

According to App Annie Intelligence, Lazada is the most actively used mobile app in Singapore, Q2 2019. To date, the Alibaba-backed e-commerce company is also the most actively used app in H1 2019 as Lazada ranked 1st in MAU in the previous quarter as well.

Among the many initiatives the company implemented that perhaps attributed to its growth was through its “shoppertainment” initiative. The campaign was launched in conjunction with the company’s rebranding campaign which aimed to uplift the shopper’s experience & empowering its sellers in areas such as branding, marketing & sales. This also benefited Lazada from its website standpoint as it rose to 1st place as the most visited e-commerce platform in Singapore, garnering an average 7.5 million visitors in Q2 2019.

From the regional point of view, Lazada’s mobile app is the second-highest most actively used shopping app & is the 2nd most downloaded e-commerce shopping app in Q2 2019. While in terms of total visits, Lazada is the second-highest most visited e-commerce website, garnering an average of 174 million visitors (desktop & mobile web) in the same period.

Shopee was the Most Downloaded Mobile E-commerce Shopping App in Singapore & Garnered More Than 2.8 Million Average Visitors

The SEA-backed e-commerce platform was probably the most successful in acquiring new consumers as Shopee was the most downloaded mobile e-commerce shopping application in Singapore in Q2 2019. The e-commerce company also saw improvements on its website as Shopee saw an increase in traffic by 11% when compared to the previous quarter, garnering more than 2.8 million average visitors in Q2 2019 in Singapore alone.

Among the many initiatives that most likely led to a high number of downloads was the introduction of various entertainment and engagement features in its recent sales event which recently saw an increase in sales up to 75% in its Shopee LIVE initiative. Shopee’s high number of total downloads was probably driven by marketing initiatives to promote its 7.7 Orange Madness sale which took place in July 2019.

Other incremental updated that possibly assisted in the high number of downloads was the introduction of additional features on its app such as a live streaming feature called “Shopee Live” that enabled sellers to engage with customers in an interactive and attractive manner.

In SEA, the Singapore-based e-commerce company is ranked 1st as the most actively used mobile e-commerce app & garnered the highest number of total downloads. In terms of the number of total visits, Shopee is also the most visited e-commerce platform, recorded an average of 200 million visitors on its website.

Qoo10 Remained as the Best Singapore-focused E-commerce Platform, Recorded the Second Highest in MAU and is the Third Most Downloaded App in the Country

The Singapore-focused e-commerce company remains a strong competitor as one of the top three most actively used app. The company recorded the second-highest monthly active users, although it only ranked the third most downloaded app – combined iOS and Google Play. Qoo10 performed consistently against the industry’s unicorns since Q1 2019 and remains as the 2nd most actively used app in Singapore for H1 2019. The e-commerce company obtained more than 7.1 million average visitors

Additionally, Qoo10 was in a further push of its growth by deepening its localisation strategy to improve consumer’s affinity towards the e-commerce platform. Commenting on the localisation strategy of Qoo10 Sarah Cheah, an associate professor at the National University of Singapore’s Business School said “They (Qoo10) started off as a local player, they had a certain advantage in familiarity with local consumers and preferences”

Taobao is the Most Actively Used Mobile E-commerce Shopping App that isn’t Tailored for the Singaporean Market

Contrasting the localisation strategy of players such as Qoo10, Lazada & Shopee, international mobile e-commerce shopping apps such as Taobao, AliExpress & Amazon were actively used in the Lion City as well. Currently the Chinese & American apps rank at 4th, 7th & 8th place respectively.

Apps by Alibaba such as Taobao & AliExpress remained prominent among Singaporean consumers probably due to the increased popularity of Chinese products and Chinese language proficiency in the country.

A similar story can be seen in the American e-commerce giant, Amazon. The data by App Annie Intelligence suggests that Singaporeans are more engaged on Amazon’s platform as compared to the localised Amazon Prime Now. This suggests that consumers remained highly interested in products from the United States as compared to products available on its Singapore-localised Amazon Prime Now app.

Please click on one of the links below to view the data in detail for each country. More findings on the top performing e-commerce companies in Singapore and Southeast Asia can be seen in Map of E-commerce Report for Q2 2019.

We are always happy to share our insights with our clients, the press, academia and more. Should you decide to utilise our data or visuals, please attribute us by including this sentence “From the Map of E-commerce, iPrice Group, July 2019” with a hyperlink to one of these URLs:

Singapore : https://iprice.sg/insights/mapofecommerce/

Indonesia : https://iprice.co.id/insights/mapofecommerce/en/

Vietnam : https://iprice.vn/insights/mapofecommerce/en/

Thailand : https://ipricethailand.com/insights/mapofecommerce/en/

Philippines : https://iprice.ph/insights/mapofecommerce/en/

Malaysia : https://iprice.my/insights/mapofecommerce/

Research Methodology for the Rankings of the Top Mobile E-commerce Shopping Apps in Southeast Asia in Q2 2019

App Annie Intelligence for iPhone and Android phone were derived from mobile usage data collected from a large sample of real-world users, combined with additional proprietary data sets. For the purposes of this report, an active user is defined as a device having one or more sessions with an app in the time period. A single person may be active on multiple devices in any time period and will therefore be counted as one user per device in the total active users. For example, when a user logs into the app, it would be counted as a session during a given month and counted as an active user.

Monthly Active Users (MAU) and Total Downloads rankings in this report are based on unified apps made possible by App Annie’s exclusive DNA. In unified apps, similar versions of the same app with different names and on different platforms are unified. For example, ShopeeSG: Lowest Price Madness on iOS, and ShopeeSG: Men Sale for Android on Google Play are all aggregated and ranked as a single Shopee unified app.

Data in this report reflects App Annie’s current estimates and DNA relationships for all time periods as of the time of publication. This includes data restatements as App Annie is continuously refining its algorithms to provide its customers with the most accurate estimates possible. Historical data may also be restated from a prior publication, a standard practice for the industry. Certain trademarks and/or images used in this report may belong to third parties and are the property of their respective owners. App Annie claims no rights in such trademarks or images.

App Category and Top App Definitions

Mobile E-commerce apps were identified by iPrice Group and App Annie from the Shopping categories on the iOS App Store and Google Play. Our analysis is limited to Apps were identified as coming from organizations that primarily sell physical products to consumers. This includes apps from organizations with no, or a limited number of, physical outlets, or universal shopping basket apps that facilitate transactions through other retailers. The analysis excludes apps that primarily drive C2C transactions, third parties providing vouchers and coupons, and apps not related to selling goods despite being from retailers.

Report Methodology for the Most Visited E-commerce Platforms in Southeast Asia in Q2 2019

All data on the total visits on desktop and mobile web in this study were taken from global traffic figures from the respective websites as of July 2019 from SimilarWeb. The following industries were not included in this list: e-ticketing, financial services, rental services, insurance, delivery service, food & beverage, meta-search, couponing, cashback websites and ecommerce who solely provides classified ads/P2P services.

To ascertain the most visited local and Southeast Asian-based e-commerce platforms on desktop and mobile web, international applications were not included in this category. Insights based on SimilarWeb data.

About App Annie

App Annie delivers the most trusted app market data and insights for your business to succeed in the global app economy. Over 1 million registered members rely on App Annie to better understand the app market, their businesses and the opportunities around them. The company is headquartered in San Francisco with 450 employees across 15 global offices. App Annie has received $157 million in financing, including from investors such as Sequoia Capital, Institutional Venture Partners, IDG Capital Partners, e.ventures, Greenspring Associates, and Greycroft Partners.

About iPrice Group

iPrice Group is a meta-search website operating in seven countries across South East Asia namely in; Malaysia, Singapore, Indonesia, Thailand, Philippines, Vietnam, and Hong Kong. Currently, iPrice compares and catalogs more than 500 million products and receives about 20 million monthly visits across the region. iPrice currently operates three business lines: price comparison for electronics and health & beauty; product discovery for fashion and home & living; and coupons across all verticals.