05 April 2022

A recent Kaspersky research showed a positive correlation between the adoption of digital payment methods and the awareness of the risks and threats that are associated with them in Southeast Asia (SEA).

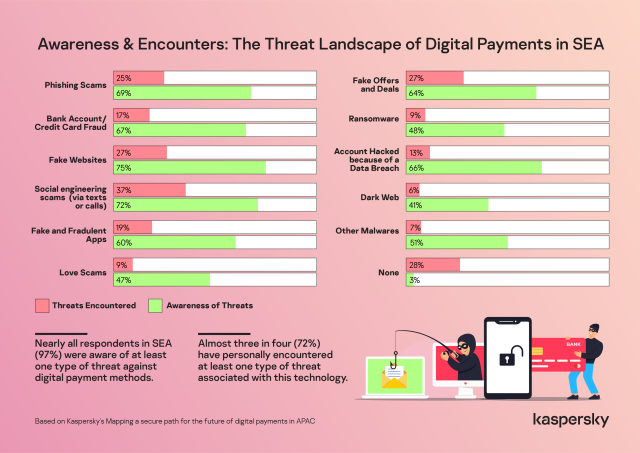

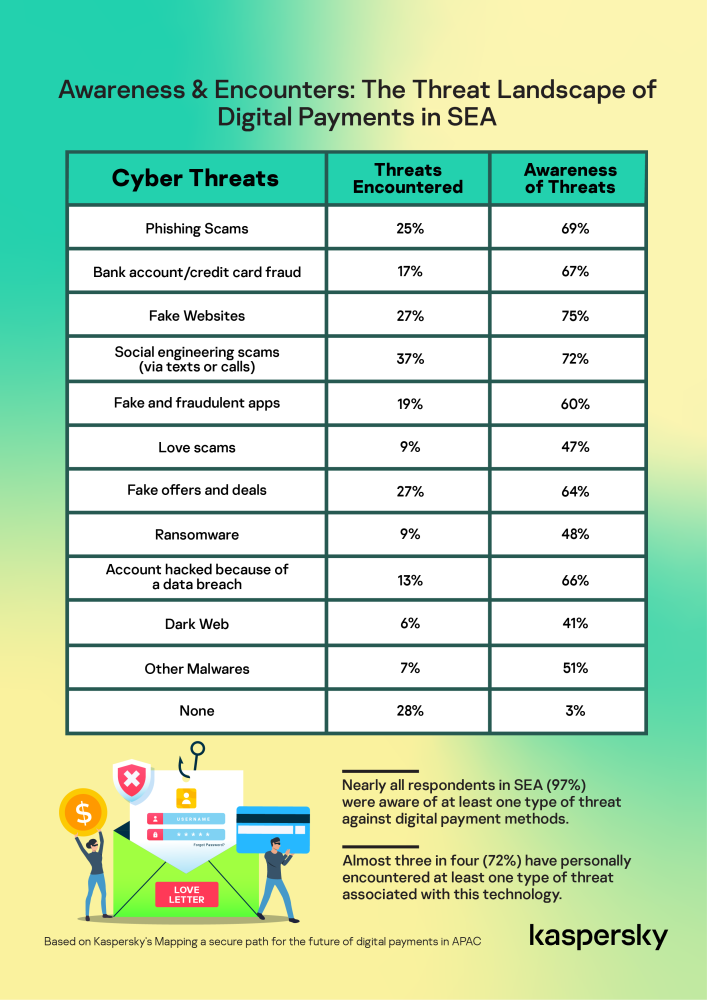

Titled “Mapping a secure path for the future of digital payments in APAC”, the study discovered that nearly all respondents in SEA (97%) were aware of at least one type of threat against e-payment platforms, while almost three in four (72%) have personally encountered at least one type of threat associated with this technology.

In many ways, this awareness could be attributed to the volume of media coverage about cybersecurity incidents, especially last year, and the combined efforts of governments and private sectors in boosting security awareness amidst the rise of mobile banking and e-wallet adoption in the region.

More than a quarter of the respondents encountered social engineering scams via texts or calls (37%), fake websites (27%), fake offers and deals (27%), and a quarter reported receiving phishing scams (25%).

Remarkably, social engineering scams are the top encountered threat for most SEA countries, including Indonesia (40%), Malaysia (45%), The Philippines (42%), Singapore (32%), and Vietnam (38%). The only exception is Thailand where its top encountered risk is fake website (31%).

Having more exposure to cyber threats could directly correlate to a higher level of awareness. Social engineering scams, fake websites, and fake offers and deals are among the most commonly encountered threats, with a large percentage of awareness at 72%, 75% and 64% respectively.

| Cyber threats | Bank account/

credit card fraud |

Account hacked because of a data breach | Fake and fraudulent apps | Ransomware | Fake offers and deals |

| Less than USD 100 | 23% | 22% | 27% | 16% | 24% |

| USD 101-500 | 13% | 8% | 9% | 8% | 9% |

| USD 501-1000 | 6% | 6% | 2% | 5% | 4% |

| USD 1,001-5,000 | 6% | 2% | 2% | 4% | 1% |

| USD 5,001-10,000 | 1% | 4% | 2% | 5% | 0% |

| More than USD 10,000 | 3% | 4% | 3% | 7% | 4% |

| None | 48% | 53% | 55% | 55% | 57% |

Percentage of respondents experiencing material impact of a cyber-incident involving digital payments

When it comes to measuring the financial impact of a cyber-incident involving digital payments, the amount of financial loss appears to be mostly capped up from less than USD 100 to USD 5,000, with a very small proportion of respondents having reported incurring a loss of more than USD 5,000.

Majority of respondents (52%) admitted that they lost money due to bank account and credit card fraud. In this group, 23% lost less than USD 100, 13% lost between USD 101-500, while 48% indicated that they did not lose any money from this threat.

Account hacked because of a data breach (47%), fake and fraudulent apps (45%), ransomware (45%), and fake offers and deals (43%) are also listed as the top 5 threats resulting in financial loss in SEA.

At the same time, the impact of a cyber threat when it comes to digital payments does not just impose a financial burden on consumers, but also affects them from a psychological perspective.

After encountering a cyber incident, more than two in three respondents from the region (67%) said that they became more vigilant. More than a quarter (32%) were also anxious about recovering their lost money.

Consumers are also concerned about their trustworthiness. Some 36% indicated they still trusted that the bank and mobile wallet provider would resolve the issue, but 18% said they had less trust in digital payment providers. Nonetheless, the consequence continued.

Over a quarter (30%) of the respondents blamed themselves for such mistake, while a small portion (12%) admitted that they involved in a misunderstanding with spouse, family member and friends because of it.

“The adoption of digital payment methods appears to be a double-edged sword, with convenience representing the good benefits and cybersecurity risks being the less desirable aspects of it. On the contrary, we believe that categorizing digital payments in such binary ways is premature. As with any emerging technologies, there is no inherent good or bad characteristic to them; rather, how we use them to achieve beneficial outcomes is determined by how we interact with them. If we are to fully realize the benefits of digital payments, it is important that all stakeholders, including the government, digital payment providers, users, and even cybersecurity firms, work together to build a stable, secure, and future-proof payments ecosystem,” says Sandra Lee, Managing Director for Asia Pacific at Kaspersky.

When it comes to action taken after encountering threats, almost 2 in 3 of respondents (64%) changed passwords and other security settings on their banking and mobile wallet apps, half of them (50%) called bank or related mobile wallet company, while 45% informed their family members and friends about the incident.

Cybersecurity protection calls more attention to consumers once they come across the threats. A tad more than a quarter of respondents (26%) said they installed security solutions on infected devices, while the same percentage (26%) said they did so whether or not their devices were infected.

Fresh start is also an option, 15% of respondents said they downloaded a new mobile wallet and created a new account simply to be safe.

To help digital payment users in SEA embrace technologies securely, Kaspersky experts suggest the following:

- Beware of fake communications, and adopt a cautious stance when it comes to handing over sensitive information. Do not readily share private or confidential information online, especially when it comes to requests for your financial information and payment details.

- Use your own computer and Internet connection when making payments online. As like how you would only make purchases only from trusted stores when shopping physically, translate the same caution to when making payments online – you’ll never know if public computers have spyware running on them recording everything you type on the keyboards, or if your public Internet connection has been intercepted by criminals waiting to launch an attack.

- Don’t share your passwords, PIN numbers or one-time passwords (OTPs) with family or friends. While it may seem convenient, or a good idea, these provide an entryway for cybercriminals to trick users into revealing personal information to collect bank credentials. Keep them to yourself and safeguard your private information.

- Adopting a holistic solution of security products and practical steps can minimise the risk of falling victim to threats and keeping your financial information safe. Utilise reliable security solutions for comprehensive protection from a wide range of threats, such as Kaspersky Internet Security, Kaspersky Fraud Prevention and the use of Kaspersky Safe Money to help check the authenticity of websites of banks, payment systems and online stores you visit, as well as establish a secure connection.

Users who would like to avail the latest Kaspersky promos to protect their devices better can visit: https://shopee.com.my/kaspersky

To read the full report, please visit https://kas.pr/b6w8.

About the survey

The Kaspersky “Mapping a digitally secure path for the future of payments in APAC” report studies our interactions with online payments. It also examines our attitudes towards them, which hold the key to understanding the factors that will further drive or stem the adoption of this technology. The study was conducted by research agency YouGov in key territories in APAC, including Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam (10 countries). Survey responses were gathered in July 2021 with a total of 1,618 respondents surveyed across the stated countries.

The respondents ranged from 18-65 years of age, all of which are working professionals who are digital payment users.

Through this study, when the behavior of the population of a market is generalised, it is in reference to the group of respondents sampled above.