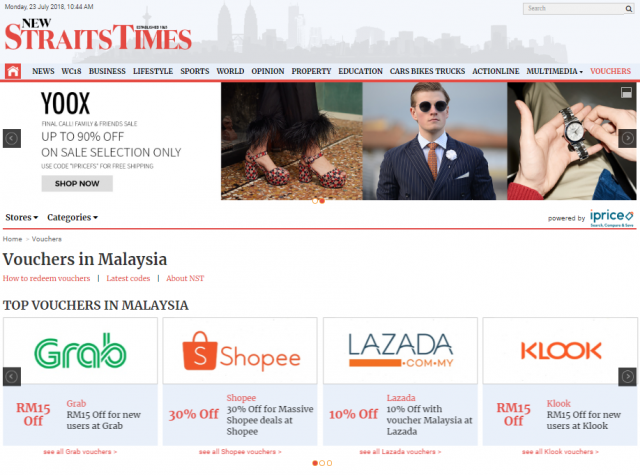

KUALA LUMPUR: The New Straits Times Press (M) Bhd (NSTP) will be working with the best local marketing platform, iPrice Group Sdn Bhd, to provide exclusive promotions and coupons for online shoppers through http://vouchers.nst.com.my/.

The website that was developed through an e-commerce platform would be launched by New Straits Times (NST) this month and would be updated daily.

NSTP digital business and development general manager, Azizi Othman, said the initiative was launched to fulfil the companies’ commitment in offering a diversity of digital products and services with add-on values for its customers.

He said apart from having an excellent reputation in Malaysia and the region, iPrice has the capability of providing a platform to compare prices of over 250 million products, making it convenient for customers to select the best option before making a purchase.

“The voucher portal will list down high-value online voucher and coupon offers from 60 e-commerce businesses in Malaysia and across the globe.

“At the same time, NST digital content will also be enhanced to establish it further and with improved quality.

“We believe that the collaboration will further strengthen the e-commerce ecosystem and improve the Customer Lifetime Value (CLV) through NST’s participation in the industry,” he said.

iPrice Group marketing chief officer, Matteo Sutto, said the company was honoured to work with Malaysia’s oldest English newspaper to provide a global shopping platform through the easiest and fastest method.

He said the rapid Internet economic growth had seen an increase of e-commerce businesses and the company had an opportunity to offer more choices to online customers by merging all the existing options.

“Reports by Google and Temasek revealed that the value of e-commece in Malaysia is expected to reach over RM33 billion (AS$ 8 billion) by 2025 and the industry is growing more rapidly than forecasted.

“NST had successfully developed along with the times since decades ago in providing the most relevant, current and comprehensive news reports to Malaysians.

“We believe that this teamwork will give even a bigger impact to millions of customers consistently,” he said.

The voucher portal will showcase the highest offers searched online like Lazada, Zalora, Shopee, Grab, Booking.com, Agoda, Expedia and others.

Shoppers can also look for the best offer easily through popular category search like electronics, fashion, health & beauty, travel & hotels, and others.

Online users will be able to maximise their savings at ‘New Voucher’ New Straits Times website in three easy steps:

- Select your coupon.

- Be sure to click and read the terms and conditions after selecting the coupon.

- Click ‘Copy Code’ and use the promotion codes when settling payments on the e-commerce websites. If there is no code, proceed to the online store to enjoy discounts.

All offers handled by iPrice Group are also available at ‘meta-search’ platforms in seven countries, namely, Malaysia, Indonesia, Singapore, Vietnam, Thailand, Philippines and Hong Kong.

About iPrice Group

iPrice Group is a meta-search website where Malaysian consumers can easily compare prices, specs and discover products with hundreds of local and regional merchants. iPrice’s meta-search platform is also available in six other countries across Southeast Asia namely in; Singapore, Indonesia, Thailand, The Philippines, Vietnam and Hong Kong. Currently, iPrice compares and catalogues more than 250 million products for millions of consumers across the region.

iPrice currently operates three business lines: price comparison for electronics and health & beauty; product discovery for fashion and home & living; and coupons across all verticals.